IR35

The IR35 rules will result in an increased tax and NI. After being informed of precisely.

Ir35 Hsq Recruitment Hsq Recruitment

Full-time temporary and part-time jobs.

. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their. Essentially IR35 affects all contractors who do not meet HMRCs definition of self employment. IR35 is tax legislation intended to stop disguised employment.

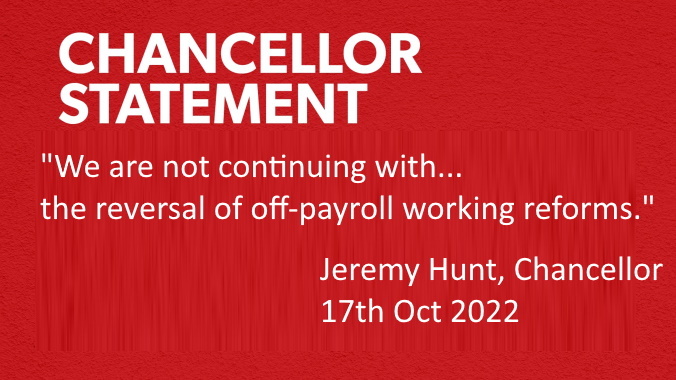

IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the. However without any warning the Chancellor has announced the entire repeal. Search and apply for the latest IT support desk jobs in England AR.

Just under two thirds 65 of business owners were aware of the new IR35 legislation and had a plan in place to deal with the changes. Full-time temporary and part-time jobs. In August this year the new Prime Minister indicated that there would be a review of the IR35 rules.

The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. The term IR35 refers to the press release that originally announced the legislation in 1999.

Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a. IR35 is another name for the off-payroll working rules. HMRCs IR35 tool Check Employment Status for Tax CEST HMRC introduced CEST in the run up to public sector IR35 reform in 2017.

IR35 refers to UK tax legislation introduced in April 2000 which is designed to make sure contractors pay the right amount of income tax and National Insurance. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and how.

The off-payroll working rules apply on a contract-by. Speaking to the House of Commons today September 23 Chancellor Kwasi. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000.

A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. It was built with the intention of. What is IR35.

September 23 2022 134 pm. The term IR35 refers to the press release that originally announced the legislation in 1999. Changes to IR35 were outlined in the recent mini-budget.

Search and apply for the latest Lead javascript developer jobs in England AR.

Changes To Off Payroll Working Ir35 Rsm Uk

Ir35 The When The Why And The What To Do

Ir35 Shock As Chancellor Jeremy Hunt Says Contractors Must Pay Same Tax As Employees It Contractor It Contracting News Advice

What You Need To Know About The Uk Ir35 Rules Goglobal

Ir35 Resolve Worsley Manchester Champion

What Does Ir35 2021 Mean For Sameday Couriers Da Systems

Ir35 Reform Delay How Tech Companies And Contractors Should Respond

Ir35 Business Solutions Salt Digital Recruitment Agency Uk Europe

What Is Ir35 A Simple Guide To Making Sense Of Ir35 Crunch

Overcoming Ir35 Changes With Global Development Teams

What Is Ir35 Off Payroll Working

What Is An Outside Ir35 Job Voyager Software

What Is Ir35 And How Can I Prepare Starling Bank

Ir35 End Of Contractor And Gig Economy Lawyers In The Uk

Ir35 Solutions Helping Businesses Become Ir35 Compliant

Repealing Chapter 10 What Can We Expect From Ir35 In 2023 Ipse

An Introduction To Ir35 And It S Possible Impact On Private Sector Contractors